indiana estate tax form

Govt Assist LLC acts as an Authorized e-File Provider as described in the instructions to Form SS-4 to help clients obtain Federal Tax ID Numbers from the Internal Revenue Service the IRS in a timely manner. Deductions applied for prior to the annual deadlines will be applied to the next years tax bill.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

First Name Last Name Company Name Mailing.

. CA SOS file no. Any transfer by a personor by that persons spouse or registered domestic partnerwill not trigger a reassessment if. The gift tax return is due on April 15th following the year in which the gift is made.

Weve made it our mission to empower you by providing good government service at a great value and continuing to build the best place in. Only a handful of states still collect an inheritance tax. CALIFORNIA FORM Real Estate Withholding Statement Part I Remitter Information 593 Escrow or Exchange No.

Govt Assist LLC only works on behalf of its clients and is in no way affiliated with any governmental or regulatory agency including the IRS. But dont forget estate tax that is assessed at the state level. Real Estate Withholding Tax Statement 2021 Form 593 Real Estate Withholding Statement TAXABLE YEAR 2021 AMENDED.

For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40. Learn more about estate tax planning in our article Illinois Estate Tax Planning Explained. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date.

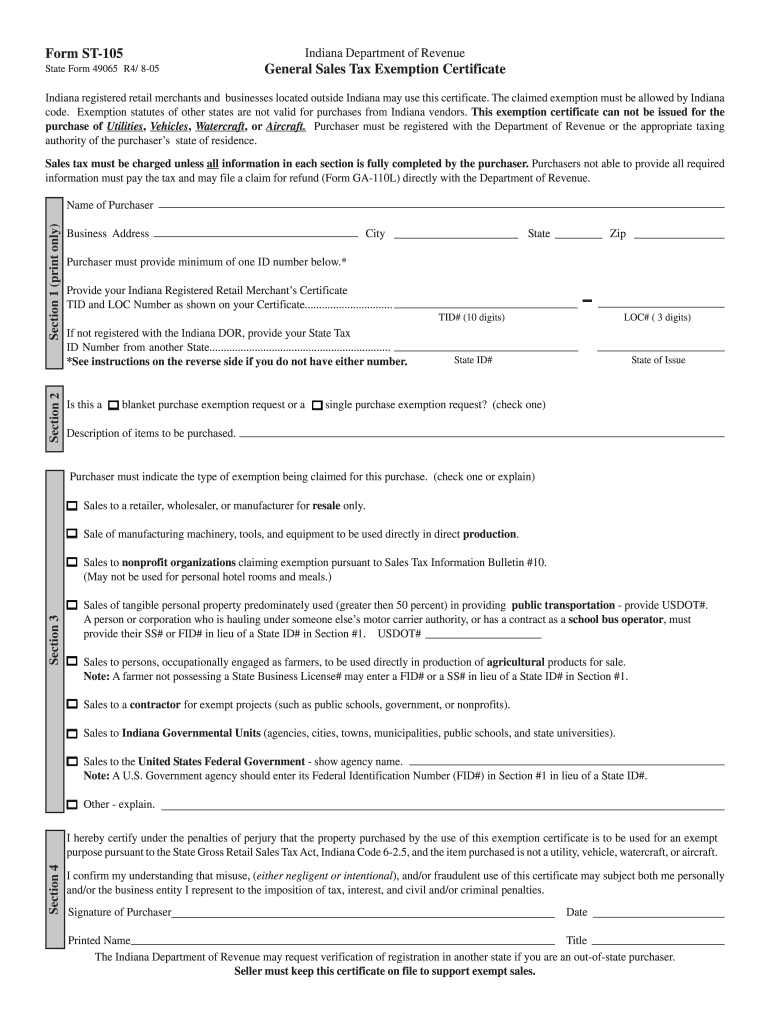

Print complete and mail the Certification Request Payment Form with your payment. Fortunately these taxes are almost a thing of the past. Companies or individuals who wish to make a qualifying purchase.

You can also order federal forms and publications by calling 1-800-TAX-FORM 800 829. Indiana Sales Tax Exemption Certificate Unlike a Value Added Tax VAT the Indiana sales tax only applies to end consumers of the product. New Jersey phased out its estate tax in 2018.

What are the recent changes to estate tax. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. Illinois estates that exceed this amount are subject to a graduated estate tax coinciding with the value of the estate with the highest rate being 16 percent.

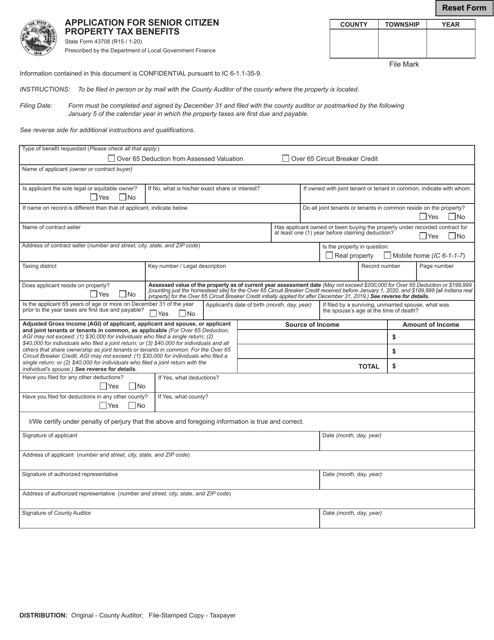

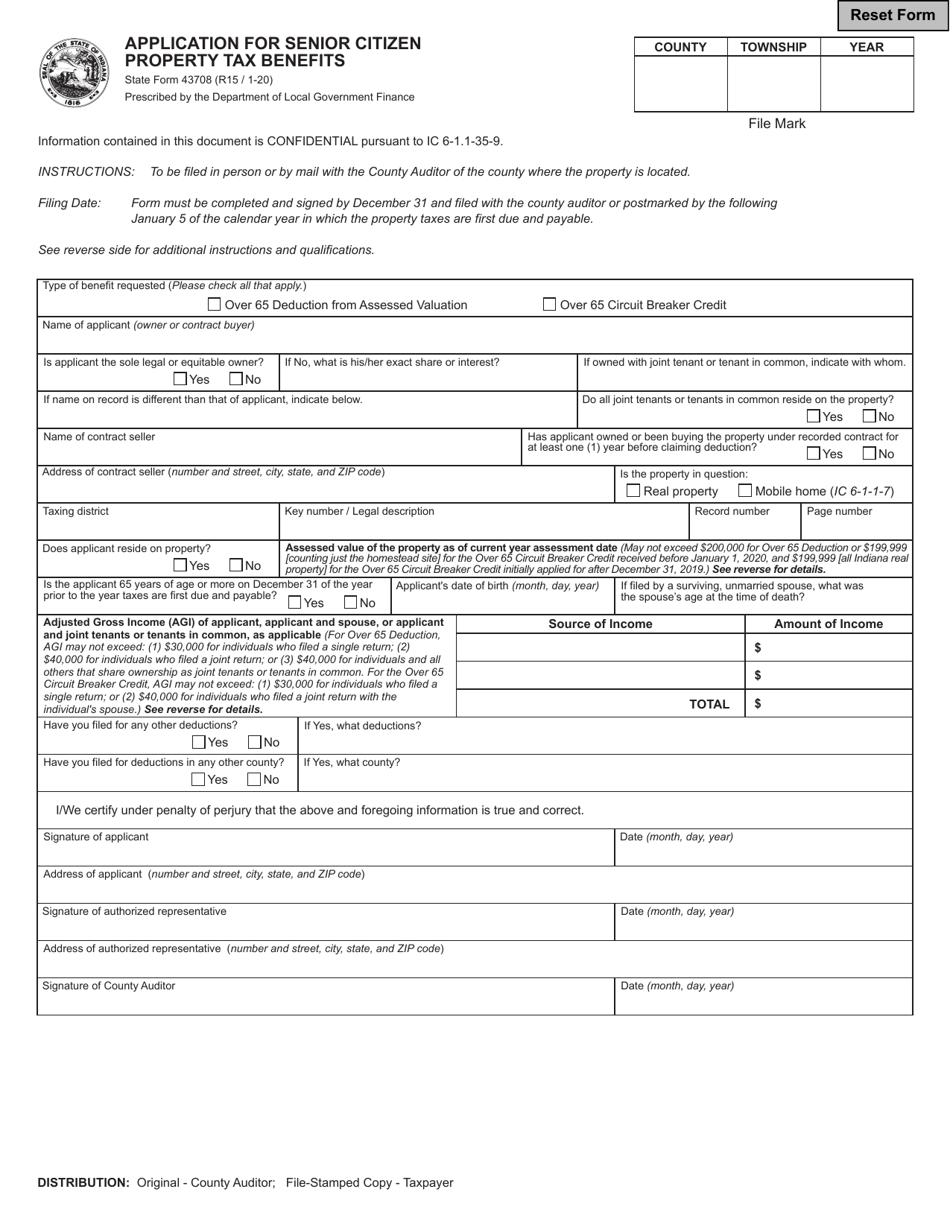

For example a homeowner who completes and dates an application for a deduction by December 31 2021 and files the application on or before January 5 2022 will see the deduction applied to his 2021 pay 2022 tax bill. The person transferring the property is the present beneficiary of the. Business name First name.

It is filed with the county auditor of the county where the property is located. An estate tax is a federal or state levy on inherited assets whose value exceeds a certain million-dollar-plus amount. Real Estate Tax Certification Request Form.

Income Tax Return for Estates and Trusts. Create Legal Documents Using Our Clear Step-By-Step Process. Individuals and companies who are purchasing goods for resale improvement or as raw materials can use a Indiana Sales Tax Exemption Form to buy these goods tax-free.

Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. Legal Info Disclaimer. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

It later turned around and repealed the tax again retroactively to January 1 2013. If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face late tax payment. Ad Get Your Legal Documents Today.

For other forms in the Form 706 series and for Forms 8892 and 8855 see the related instructions for due date information. Those states with a tax have a relatively high threshold before taxes are due. The deed must include the mailing address to which the property tax statements should be mailed.

Whether you call Indiana home or visit our great state no matter what youre looking for youll find it here in Indiana. If you need to contact the IRS you can access its website at wwwirsgov to download forms and instructions. An inheritance tax is a state-imposed tax that you pay when receiving money or property from a deceased persons estate.

There are actually twelve states along with the District of Columbia that levy an estate tax and most have exemption amounts that are lower than the federal amount. Tennessee repealed its estate tax in. Please allow 3-5 business days for a response.

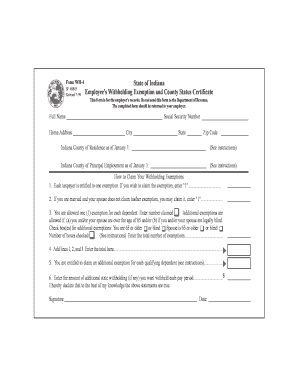

The employer is required to withhold Indiana state income tax from the employees wages at the enacted Indiana state income tax rate of 330 plus the applicable Indiana county income tax rate Lake County 050 for wages earned. Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now. In Illinois the exemption level is 4 million dollars.

Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later. The Indiana Real Estate Sales Disclosure Form must identify the grantor and grantee list the value of the property described in the deed.

Estate executors use IRS Form. _____ REEP Qualified Intermediary BuyerTransferee Other_____ FEIN CA Corp no. The federal estate tax return has to be filed in the IRS Form 1041 the US.

For example in 2016 a full year Illinois resident works the entire year in Munster Indiana Lake County. The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. Also to note that the Schedule K-1 should be properly filled if the trust has transferred an asset to a beneficiary and claimed a deduction for that.

The California Revenue and Tax Code recognizes that transfers to living trusts for estate planning purposes rarely involves a change in ownership. Therefore you must complete federal Form 1041 US. The 2021 rates and brackets were announced by the IRS here What is the form for filing estate tax return.

Indiana State Form 43708 Form Ead Faveni Edu Br

Indiana W4 Fill Online Printable Fillable Blank Pdffiller

Indiana State Form 43708 Form Ead Faveni Edu Br

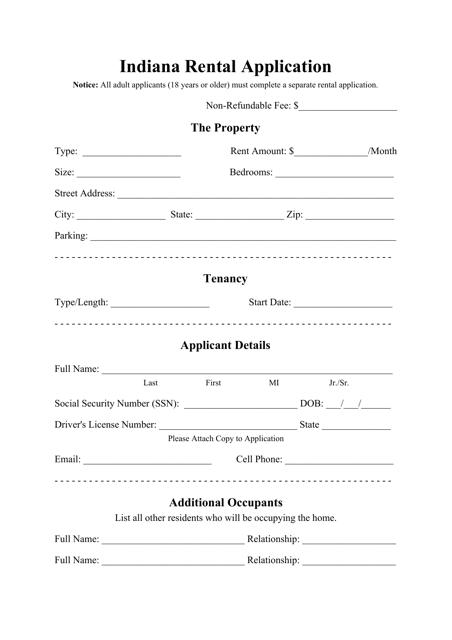

Indiana Rental Application Form Download Printable Pdf Templateroller

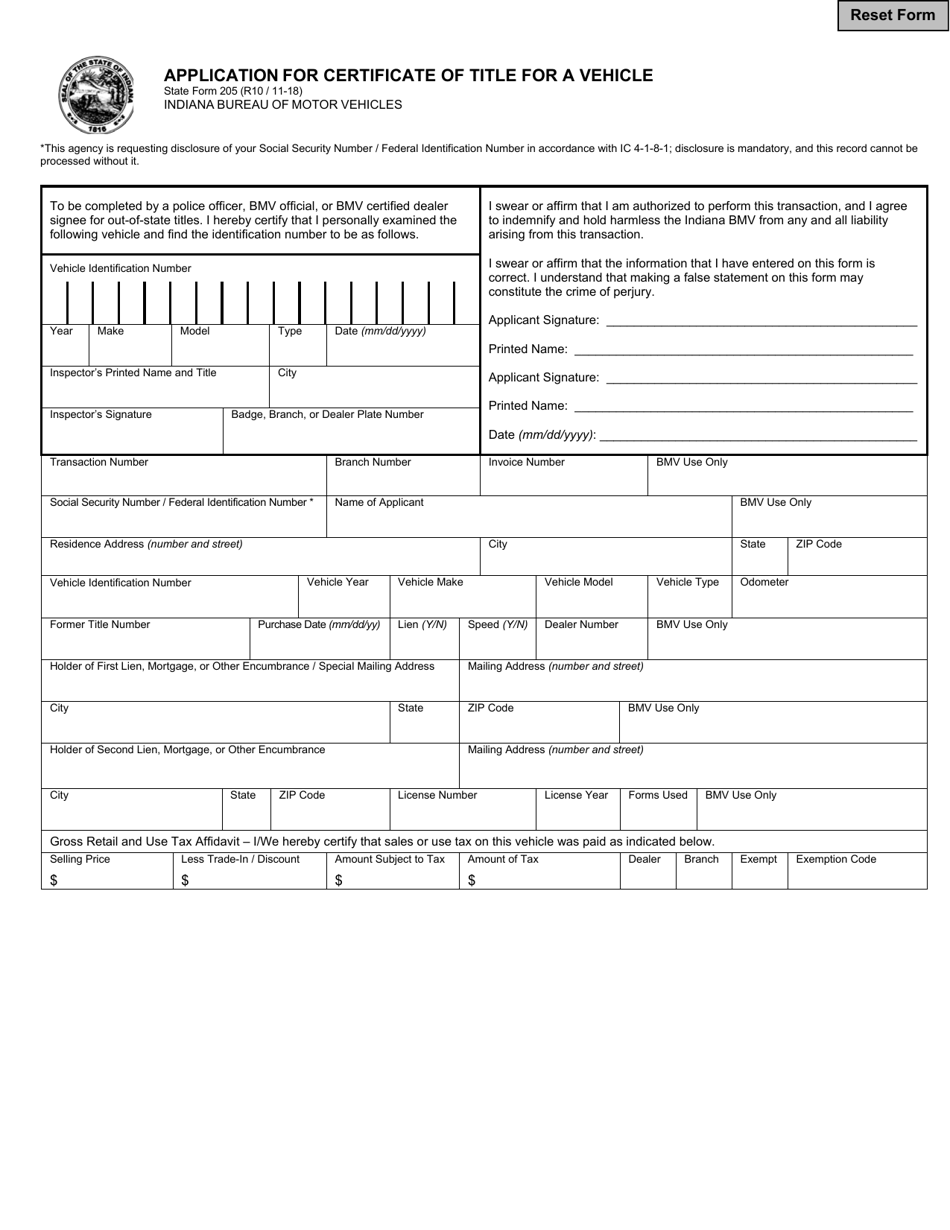

State Form 205 Download Fillable Pdf Or Fill Online Application For Certificate Of Title For A Vehicle Indiana Templateroller

Ohio Quit Claim Deed Form Quites Ohio Marital Status

Indiana W4 Pension Form Fill Online Printable Fillable Blank Pdffiller

State Death Tax Hikes Loom Where Not To Die In 2021

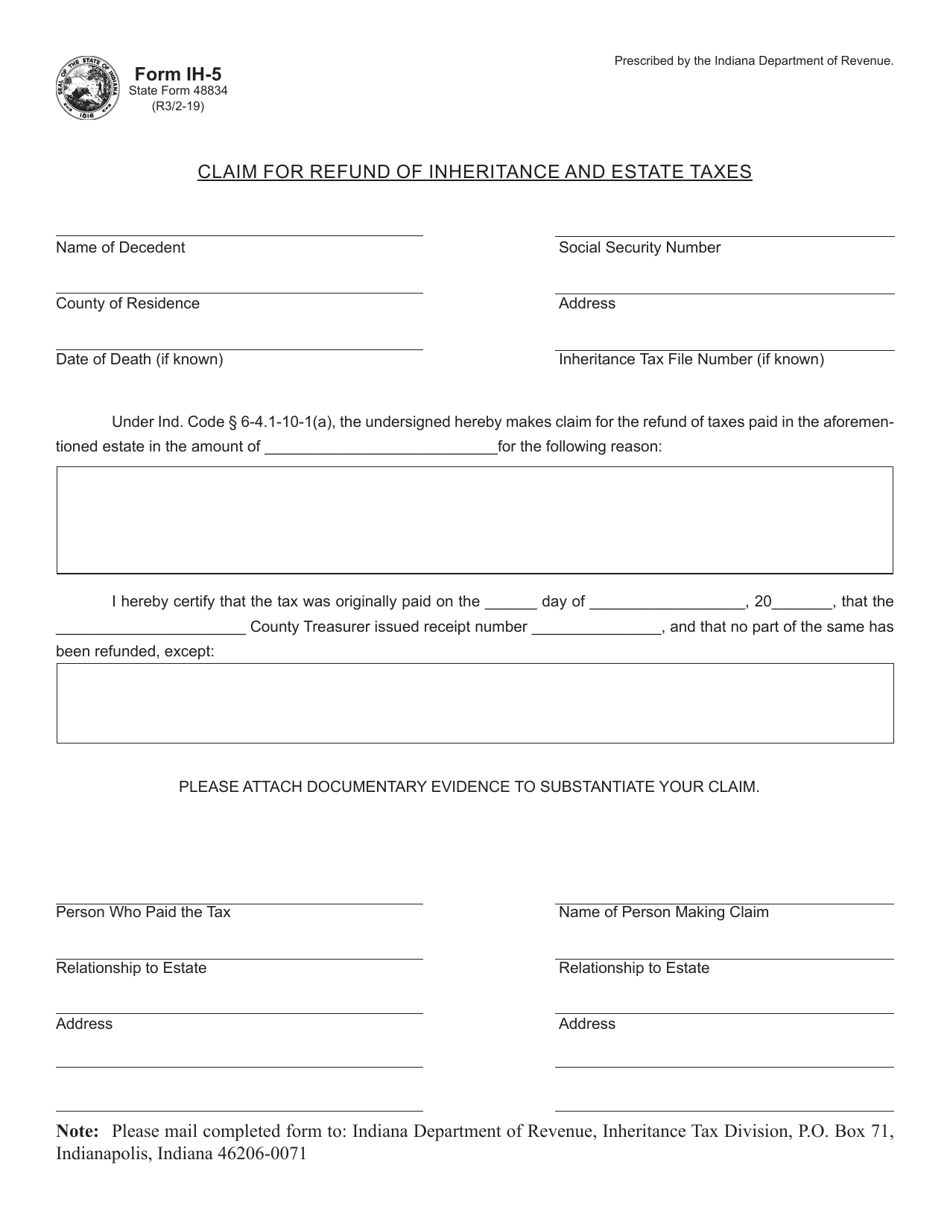

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

Indiana Generic Bill Of Sale Form Download Printable Pdf Templateroller

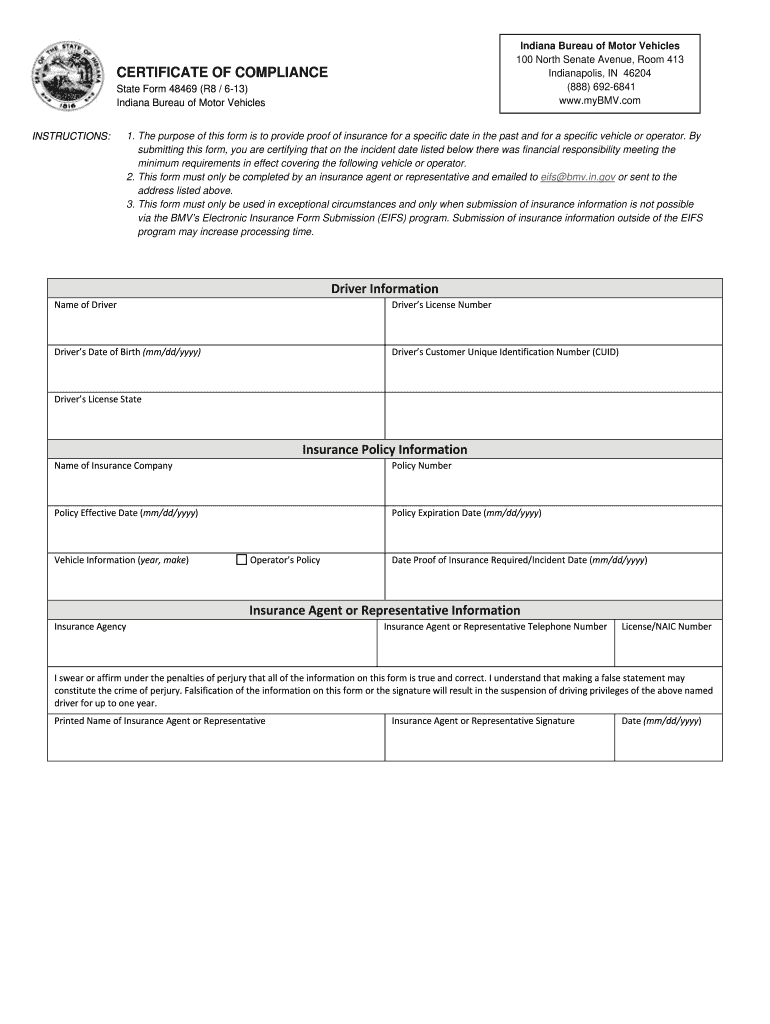

Certificate Of Compliance Indiana Fill Online Printable Fillable Blank Pdffiller

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Free Indiana Small Estate Affidavit Form Pdf Word Template Sample Resume Format Letter Addressing Power Of Attorney Form

Free Indiana Revocable Living Trust Form Pdf Word Eforms

/writing-hand-pen-money-office-math-699519-pxhere.com1-689d978232b349a0b997494f7d98728a.jpg)